Why Isn't My Refund Updating

800-829-1040 7AM-7 PM local time Monday-Friday. A note about IRS system issues and refund delays.

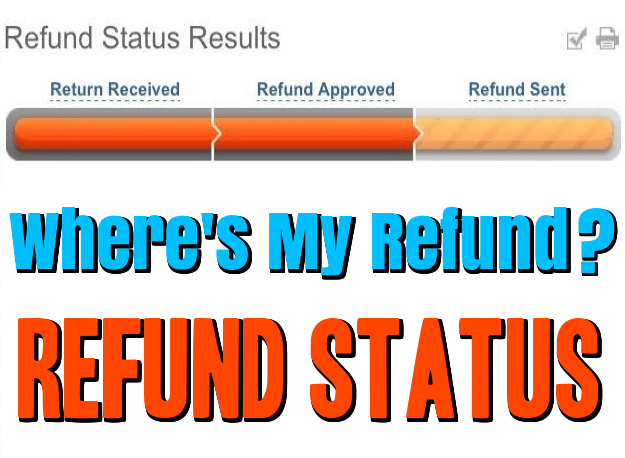

Wheres My Refund.

Why isn't my refund updating. Dont count on getting your refund by a certain date to make major purchases or pay other financial obligations. The IRS is mailing letters to some taxpayers who claimed the 2020 credit and may be getting a different amount than they expected. Refund or it will send you to an automated phone line.

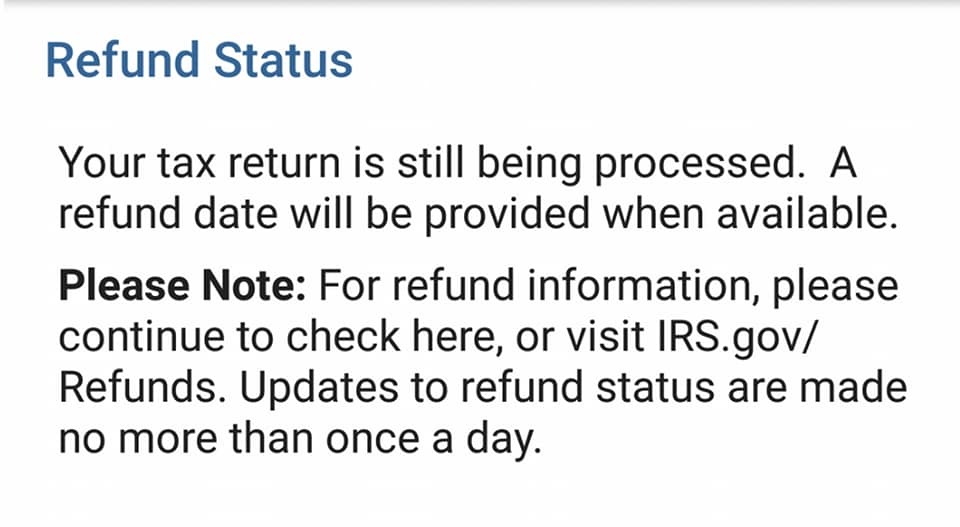

In most cases the status of a filers refund is not displayed for an average of 72 hours. You must wait at least 24 hours after you get the acknowledgment e-mail that your tax return was received by the IRS. A litany of issues has led to delays at the IRS.

You can track the status of a tax refund by using the IRS online Wheres My Refund portal. Then press 2 for personal income tax. First choose your language.

The good news is the IRS says delays with the tool do not mean that returns themselves have been delayed. Rule number one is Dont Panic Chances are your refund status is simply delayed because of the fact that they have to handle millions of accounts just like yours. The delays in issuing refunds this year are unavoidable given the complexity of the tax changes authorized by several stimulus packages over the.

Your refund will also be delayed if you made an error or your return was incomplete. IR-2021-76 April 5 2021 As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC. In an update on its website it noted that some visitors to the Wheres My Refund.

When you provide your account number and bank routing number its important to double check that the information is accurate. No one wants to miss out on a refund because it went to the wrong bank account. Is available almost all of the time.

The online tool is updated once a dayusually overnight. This is most common when the IRS is conducting a mail audit on your EITC or ACTC return from a prior year. The IRS citing coronavirus pandemic-induced problems for Americans pushed the traditional Tax Day deadline of April 15 for filing 2020 taxes back a month to May 17But it wasnt only average Americans struggling with pandemic ills the IRS too was trying to cope with its own staffing challenges Fox Business reported.

Your e-filed return was accepted received by the IRS less than 24 hours ago. When calling the IRS do not choose the first choice re. They Serve Over 300 Million People.

We cannot provide any information about your refund. For example if your refund was sent to a bank account that youve since closed the IRS will eventually cut you a paper check but that adds to the wait time. But your tax refund could also be delayed for all the reasons that would apply in a normal year.

We issue most refunds in less than 21 calendar days. Midnight to 7 pm. I Got My Refund.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts or that used 2019 income to figure the Earned Income Tax Credit EITC and Additional Child Tax Credit ACTC. Heres how to reach a live agent at the IRS. It appears that the IRS is again having issues with processing returns in a timely manner and so a number of people are seeing delays in getting their refunds or updates in the status of their refund on the WMR toolapp.

Reasons the IRS Might Not Show Your Refund Status. The coronavirus pandemic has created additional urgency this year for Americans expecting tax refunds particularly as many have not been able to rely on other forms of relief from the government. Normally youll receive IRS Letter CP88 indicating that your refund is frozen until the IRS completes the audit.

Even though the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days its possible your tax return may require more review and take longer. Most taxpayers now receive refunds via direct deposit into a bank account. The IRS can delay your tax refund until it completes any audits.

Millions of people lost work in 2020 and despite calls from economists for regular direct payments Congress has authorized only two stimulus checks so far with a third one expected in the. Midnight to 3 am. If you do not have internet access call IRSs Refund Hotline at 1-800-829-1954.

Reason for Tax Refund Delay. However our system is not available every Monday early from 12 am. Here are a few reasons why you may be getting the following message at Wheres My Refund.

Our Refund Trace feature is not available during the following times Eastern Time. Then listen to each menu before making the selection.

Irs Tax Refund Delays Explained And How To Track Your Money Cnet

Why Is It Taking So Long To Get My Tax Refund And Still Processing After 21 Days Why Your 2020 Return In 2021 May Be Delayed By The Irs Aving To Invest

Direct Sales Tax Deductions Business Tax Deductions Tax Deductions Business Tax

2021 Tax Refund Delays 2020 Tax Year Late Tax Refunds

Irs Resequenced Or Unpostable Tax Return

Where S My Refund Home Facebook

Top 5 Online Conference Call Services With Outlook

Bonus Depreciation What It Is And How It Works Tax Help Financial Advice Personal Finance

Refund Request Form Template Mactemplates Com Words To Use Refund Templates

Where S My Refund Home Facebook

Spend Your Tax Refund At United By Blue Plastic Bottles The Unit Recycled Throws

Here S One Pretending To Be From American Express Telling Me To Update My Phone Number Or My Account Will Be Suspend American Express Phone Numbers Expressions

Irs To Launch Get My Payment Application For Those Without Banking Information On Return News Break Helping People Show Me The Money Irs

How To Get A Bigger Refund With Tax Software Tax Software Tax Prep Tax

Business Tax Refund Flyer Business Tax Tax Refund Flyer Template

Post a Comment for "Why Isn't My Refund Updating"